Key Insights:

- While the UK labor market is not as exceptionally tight as it was in 2022, it remains surprisingly tight, especially when considering the challenging economic circumstances.

- Job-to-job transitions surged to a record high throughout 2022 as workers actively sought better opportunities, driven by the tight labor market and cost-of-living concerns.

- Despite global tech slowdown fears, Ireland faces historically low unemployment and an employment rate at record high.

UK: The labor market flip-flops from tight to loose within a year

It is no exaggeration to say that the U.K. economy is having a massive growth problem. Even with the most recent ONS revision to the data, GDP is less than 2% larger than at the end of 2019. Moreover, economic growth has been stagnating for a year even as the economy has avoided a recession. To make matters worse, forecasters are projecting another two years of low growth ahead and expecting the U.K. economy to fall into recession by the end of this year.

But even with all the economic challenges that the country is facing, the U.K. labor market was still extremely tight in 2022. Our own estimates show that labor demand was exceeding labor supply as the economy recovered from the pandemic lockdowns. In fact, unfilled vacancies surged to a record-high of 1.3 million in the summer of 2022, which is about half a million more open positions than in 2019.

While recruiters had enormous difficulties finding staff last year, the labor market is now normalizing quickly. Vacancies have fallen sharply and dipped below one million, a decline of more than 30%. While the number of vacancies is still above pre-pandemic levels right now, the expectation is that they will continue to decline.

Job-to-job transitions also surged to a record high throughout 2022. As the pool of available workers on the sidelines was shrinking, recruiters increasingly hired workers from other companies. And with the tight labor market and the cost-of-living crisis in the UK, many employees have been mo re than willing to switch their jobs for a better salary or better benefits.

Our own research shows that poaching will become more common in the future as labor supply will not keep up with labor demand in many advanced economies due to adverse demographics.

Even as the economy was barely growing over the last year, the labor market continued to expand and defy the BoE’s hawkish predictions of a rising unemployment rate.

The super-tight labor market in 2022 was a combination of several factors. First, Brexit led to a massive negative supply shock. There continue to be labor shortages in many blue-collar occupations, such as hospitality, warehousing, and trucking, as the supply of EU workers in those industries dried up. Net migration from the EU has been negative since 2019. Second, the Covid pandemic had a negative effect on the domestic labor force as well with many workers becoming inactive. The number of persons being inactive due to long-term health reasons increased by 25 percent since the beginning of the pandemic, and currently stands at 2.6 million people. Third, the speedy economic recovery in 2021 and 2022 was accompanied by a temporary hiring boom in tech and finance.

While net migration from outside the EU reached a record high last year, the composition of migrants has changed a lot. A large share of the immigrants coming to the UK right now are either students, skilled workers, or their dependents. These immigrants, however, do not provide relief for the missing workers in the food and hospitality sector and other manual occupations. Labor shortages in those occupations thus remain as the inflow of blue-collar workers coming from the EU has stopped.

Payroll employment now falling?

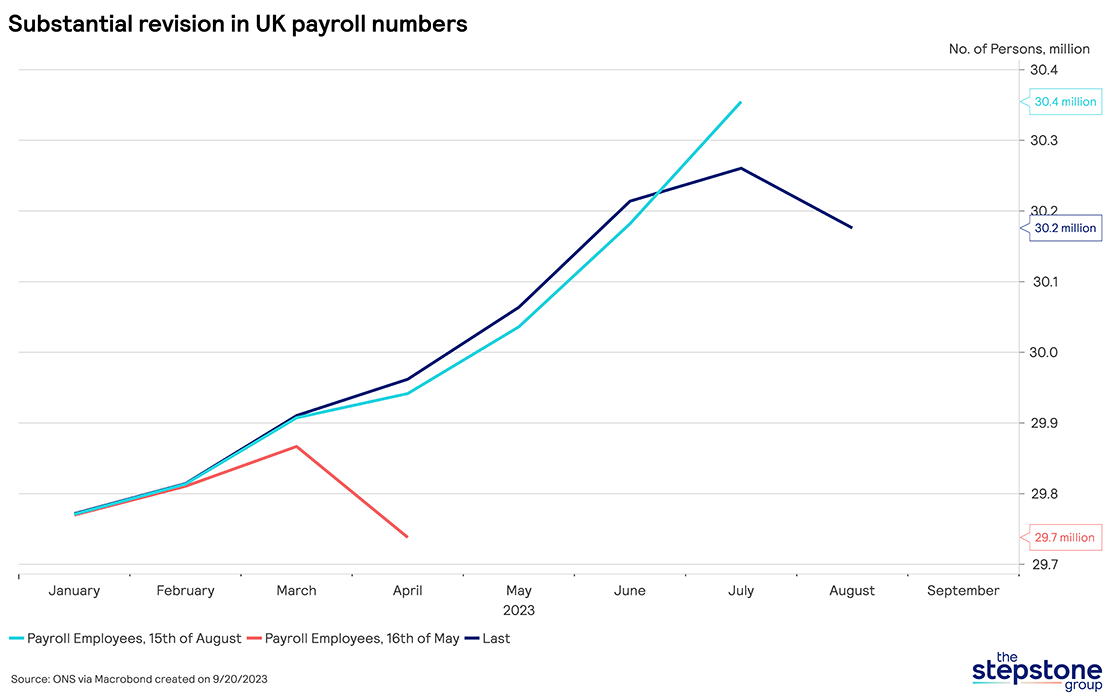

Despite little economic growth, the U.K. labor market has been holding up fine this year and payroll employment continued to grow. The most recent data point though shows a contraction, or at least stagnation – depending on whether one uses the seasonally adjusted or non-seasonally adjusted data.

What should be noted is that these figures can also be subject to large revisions. In fact, the massive April decline in payroll numbers (a job loss of about 130,000) was completely revised away when the new May figures were released. The new data now shows that the total number of payroll employees increased by about 90,000 in May, followed by another small increase in June and July, now exceeding a new high of more than 30.2 million.

However, labor market conditions in the U.K. have clearly been easing for several months. The unemployment rate has ticked up since last summer. The tech boom has also run out of steam and even went into reverse with many large tech companies starting to have layoffs. More generally, the current economic stagnation is leading to lower labor demand across most sectors with vacancies declining rapidly and redundancies rising.

What does that mean for recruiters?

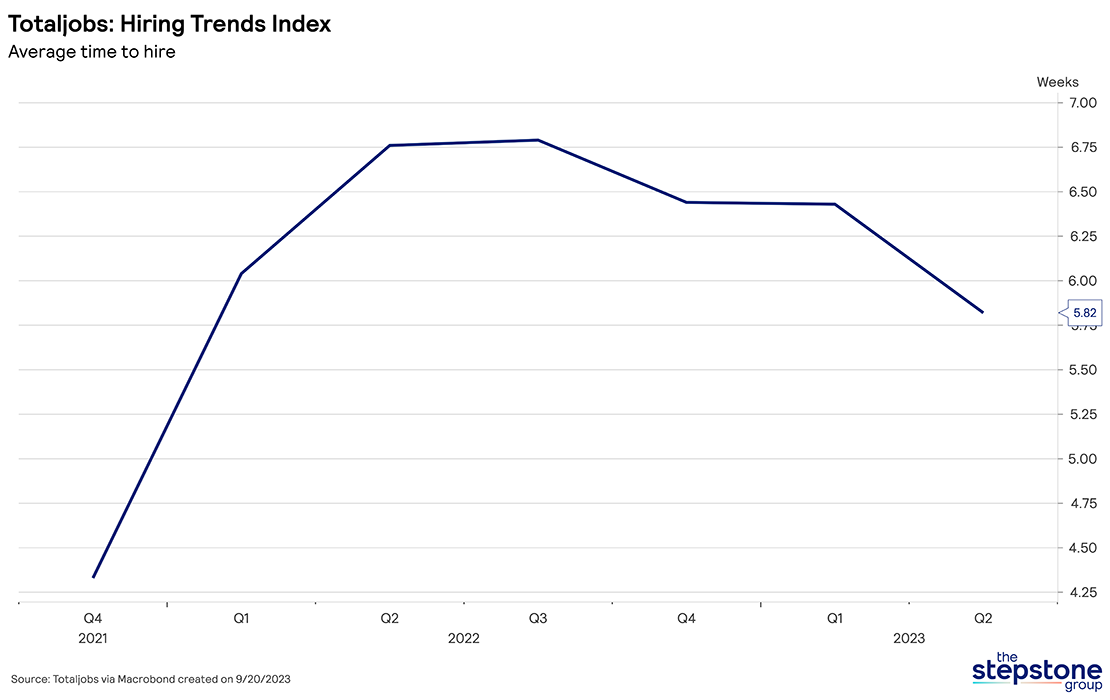

Data from the Bank of England shows the extent to which recruiters found it difficult to fill positions. throughout 2021 and 2022. Totaljobs data shows that during that time, it also took much longer for companies to fill open positions. The average time to hire increased from about four weeks at the end of 2021 to almost seven weeks in early 2022 but has now declined again this year.

Evaluating the shifting dynamics of the labor market, we uncover both challenges and openings for recruiters. In comparison to the tight labor market of 2022, recruitment difficulties have clearly been easing over the last year. However, it's crucial to understand that even now, the labor market remains historically challenging, especially within the complex landscape of the UK economy. Despite economic uncertainties (e.g.the housing market, high inflation and wage growth), our outlook suggests that the UK's labor market will continue with a relatively low unemployment rate, likely around four to five percent, in the near future. Demographic shifts, challenges in terms of labor migration and growing global competition for talent indicate that the market will tighten again.

Recruiters should consider seizing the current window of opportunity to proactively build talent pipelines and streamline recruitment processes. Capturing this moment requires both immediate action and a forward-thinking, adaptable approach. By remaining agile and concentrating on long-term talent strategies, we can position ourselves for success in an ever-evolving labor market.

Ireland: Growth resumes as the tech slowdown reverses and construction booms

Dublin is well-known for being one of the major European IT and finance hubs. Last year, it was feared that the tech slowdown in the US would spill over to Ireland and negatively affect the domestic economy and local labor market. Some economists back then warned about an upcoming Irish recession.

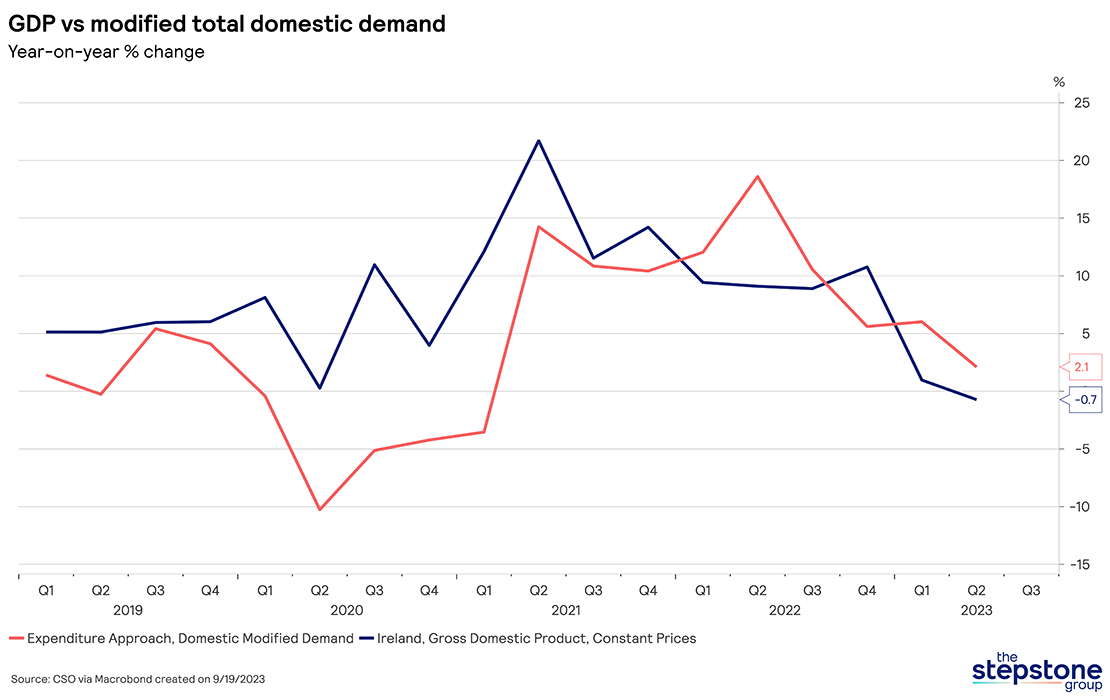

It turns out that this worry was unwarranted. The Irish economy continues to grow faster than most other European countries. The central bank’s preferred measure of domestic economic activity – modified domestic demand - shows a year-on-year increase of about two percent in Q2 of 2023, with positive momentum carried into the third quarter.

The reason why economists use that particular measure for Ireland is because the country’s GDP statistics are notoriously unreliable. They are severely distorted by profits booked by international companies in Ireland due to its low corporate taxes.

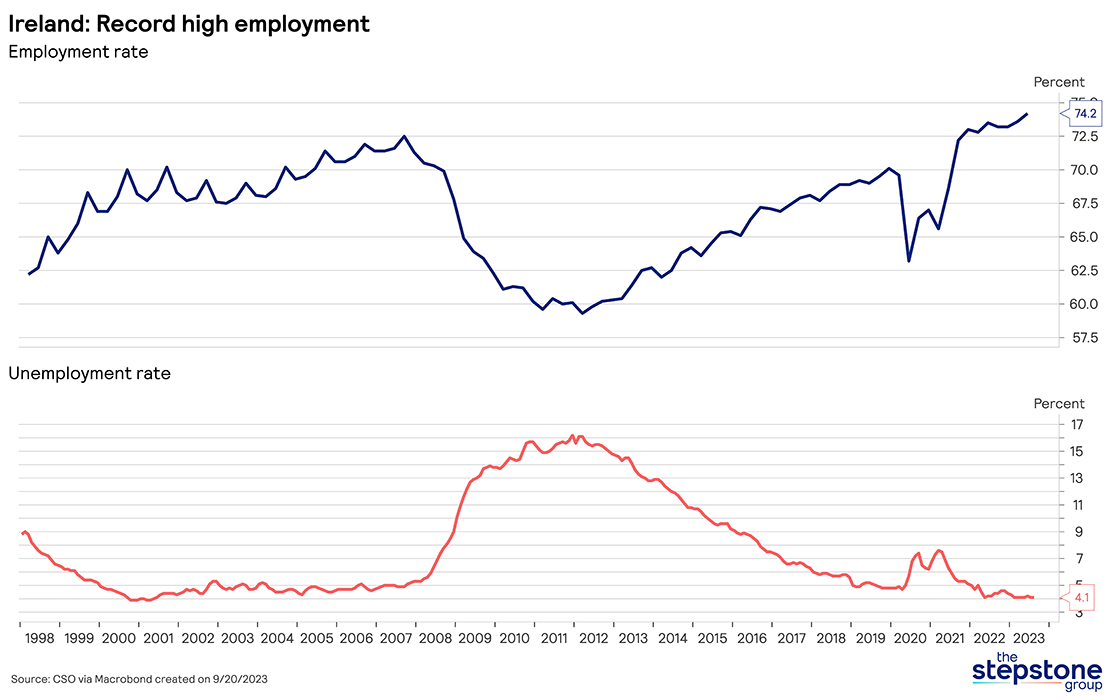

Ireland’s unemployment rate remains steady at a low of 4.1%. The last time Ireland’s unemployment rate was so low for a prolonged period was before the financial crisis of 2008.

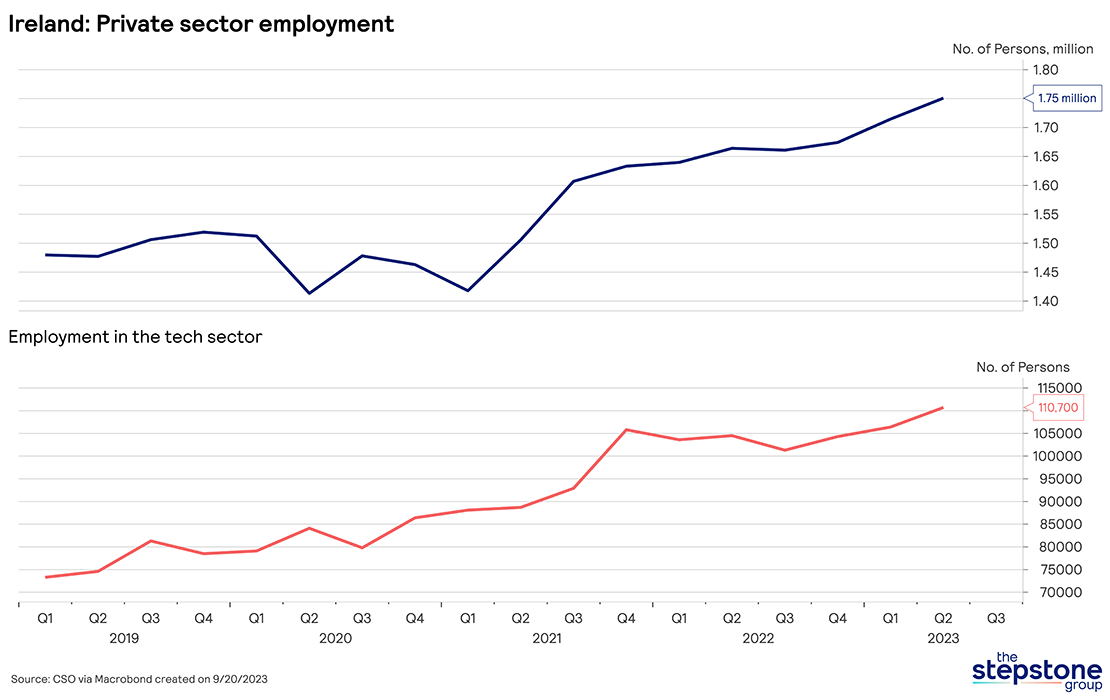

And Ireland’s employment rate has increased to a record-high of 74.2%, a value never reached before. Private sector employment continued to grow throughout this year and is now exceeding 1.75 million. Moreover, employment in the tech sector also stands at a record high of 110,000, some 50% higher than in 2019.

As the next chart shows, employment in the tech sector previously peaked in the first quarter of 2021 and then slightly declined throughout 2022. However, this dip turned out to be minor, and also temporary. Employment growth in the tech sector resumed this year. Suffice it to say that the Irish labor market has been unaffected by the tech slowdown and surging interest rates in the Eurozone.

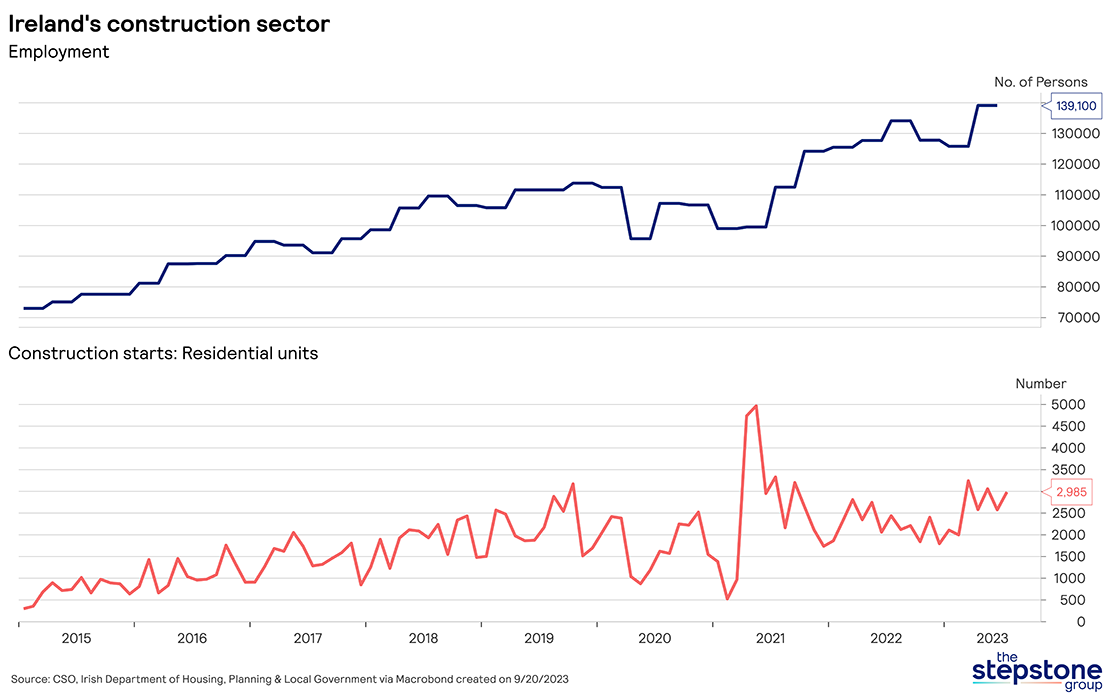

The construction sector in Ireland also picked up steam at the beginning of the year, growing by 12% in the first quarter of 2023. Employment in the sector continued to expand during the pandemic. It just reached a new high of almost 140,000 workers and is now some 25% higher than in 2018. Construction starts for residential units have increased slightly compared to the pre-pandemic period. This is also good news since the country is suffering from a significant housing shortage.

What does that mean for recruiters?

The Irish economy has been unscathed from the troubles in the global tech sector last year and the country is outperforming most other European economies. Ireland’s labor market is currently very tight. The employment rate reached a new record high, and the pool of unemployed workers has been shrinking. Even the slowdown in the tech sector turned out to be temporary. After some minor job losses, employment growth in tech resumed in 2023 and reached a new high in Q2. Moreover, employment in other sectors, most notably construction, also continues to expand. Absent a major global economic downturn, one should expect more tightness in the Irish labor market for the foreseeable future as the economy continues to grow steadily.