Germany is experiencing a “full-employment recession”

Key insights:

- Germany's economic downturn is emphasized by its waning industrial sector

- Like Japan's "full-employment recessions", Germany's tight labor market persists despite economic challenges, driven by aging demographics and firms' reluctance to release staff.

- As the economy faces headwinds, recruiters should anticipate sustained labor tightness, prolonged vacancy durations, and rising hiring costs.

- Such labor market trends in Germany signal potential similar challenges ahead for the broader Eurozone, as demographics shift and "full-employment recessions" become more commonplace.

Germany’s economic growth has been weak

Germany’s economic growth has disappointed in recent years and it is the only large European economy with GDP still slightly below its pre-pandemic level – the sick man of Europe again.

While the massive economic contraction due to the energy crisis that was predicted by many forecasters for 2023 never materialized, growth has been extremely lackluster. At the end of last year, Germany fell into a technical recession, two consecutive quarters of negative GDP growth, and more recent data is pointing toward further contraction in 2023.

One big reason for Germany’s underperformance is the fact that the country is still quite reliant on its industrial sector, which hasn’t been a growth engine anymore since about 2018. Germany’s car manufacturing sector, one of the country’s most important industries, has seen its output decline significantly, and German industrial production has stagnated in general.

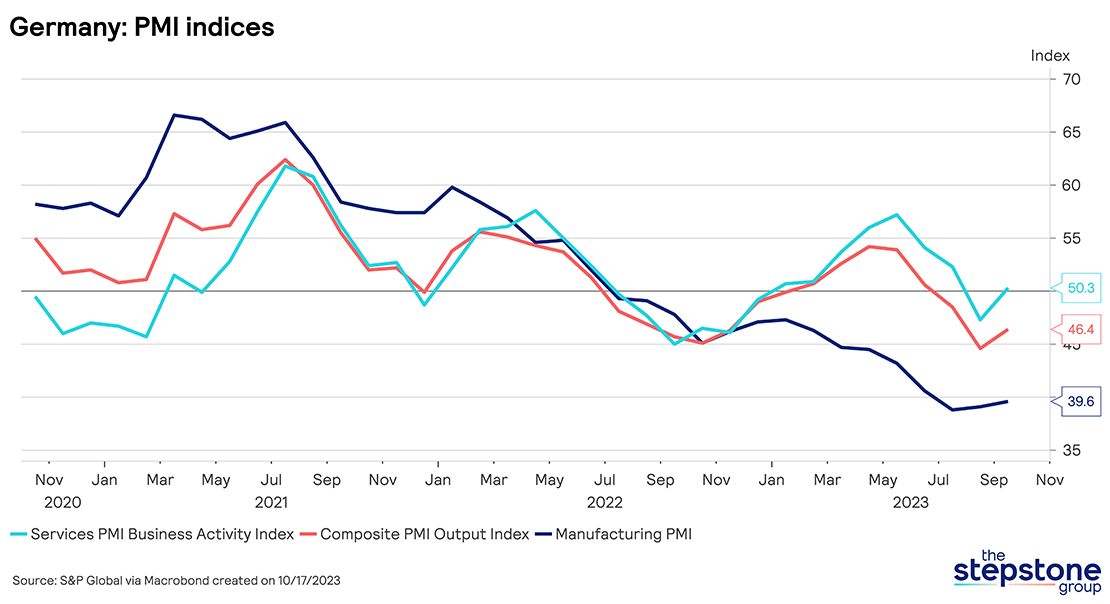

While there was a small rebound during the economic recovery in early 2021, the Purchasing Managers Index (PMI) shows a significant downturn in the German industrial sector since the end of last year (values below 50 represent a contraction). The composite PMI also just fell below 50, indicating that also the service sector continues to contract.

First Japan, now Germany and the Eurozone: “Full-employment recessions”

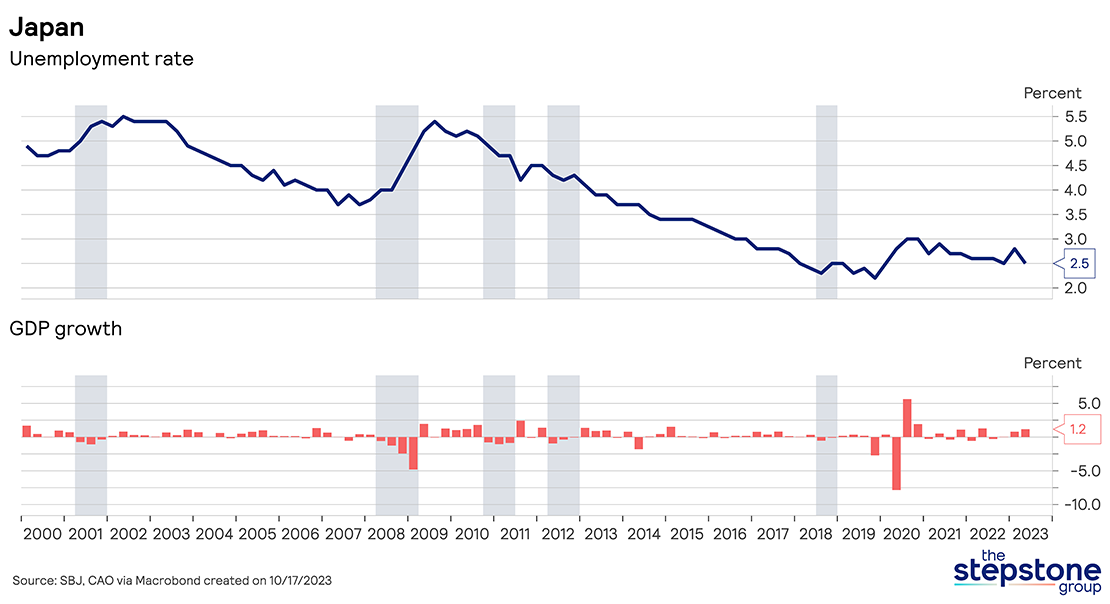

Despite the poor economic performance more recently, Germany’s labor market remains extremely tight. While this might seem puzzling at first, Japan was the first country to experience several recessions in recent decades while also having a very low or even falling unemployment rate. And that is because Japan’s population has started to shrink since 2010. With a rapidly shrinking labor force, trend GDP growth in the economy has substantially declined. Moreover, productivity has also been disappointing since the late 1990s, putting further downward pressure on growth rates.

Japan’s unemployment rate therefore continued to decrease even as the economy stuttered, simply because the country’s labor shortage problem worsened over time.

Germany’s labor shortages worsen as the country is aging

Both – adverse demographics and mediocre productivity growth – can explain why rapidly aging economies like Japan and Germany are experiencing such “full-employment recessions” – an economic contraction combined with a strong labor market.

In Germany, all economic downturns since the financial crisis of 2008 have only led to temporary and very modest increases in the unemployment rate, which was subsequently reversed.

While institutional factors also play a role – German companies have generally tried to implement furlough schemes for workers during downturns instead of letting them go – more European countries will experience technical recessions in the future that will only have a limited effect on employment as worker shortages become more prevalent.

Moreover, many companies are currently scarred from struggling to attract workers during the recent labor shortages in 2022 when the labor market was extremely tight. Companies are therefore more likely to engage in labor hoarding during the next economic downturn. They will rather reduce hours worked and aim to keep workers on payroll instead of letting them go outright because they might struggle to get workers back quickly enough once the economy picks up again.

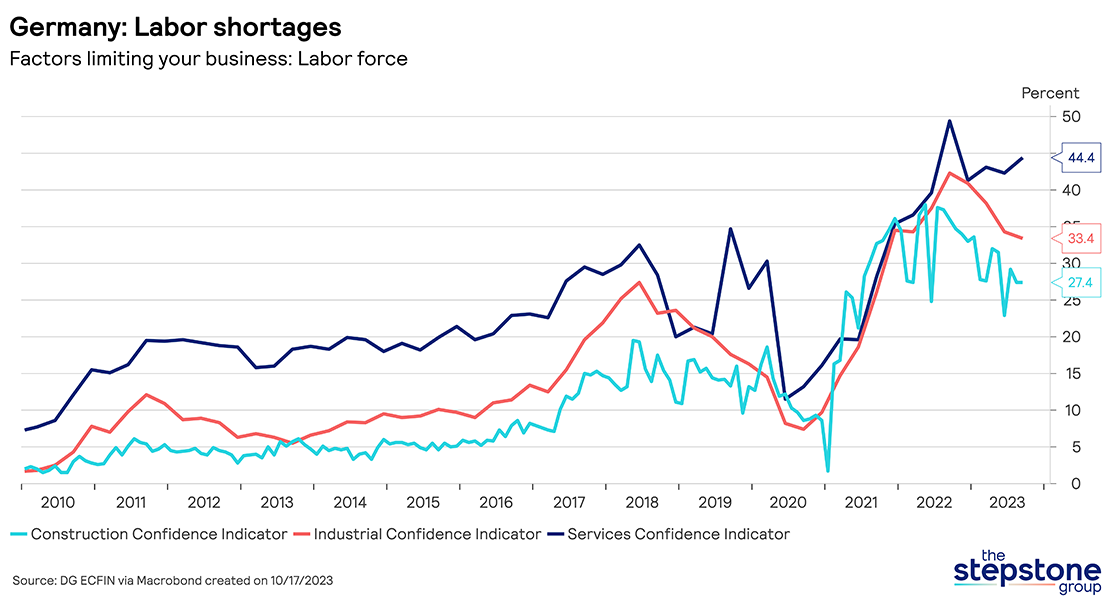

The following graph shows how firms across all sectors already perceive the current situation as difficult when it comes to hiring workers. An increasing number of companies report that labor is the limiting factor that is constraining production. Missing workers are ultimately hurting both the overall level of output as well as productivity growth.

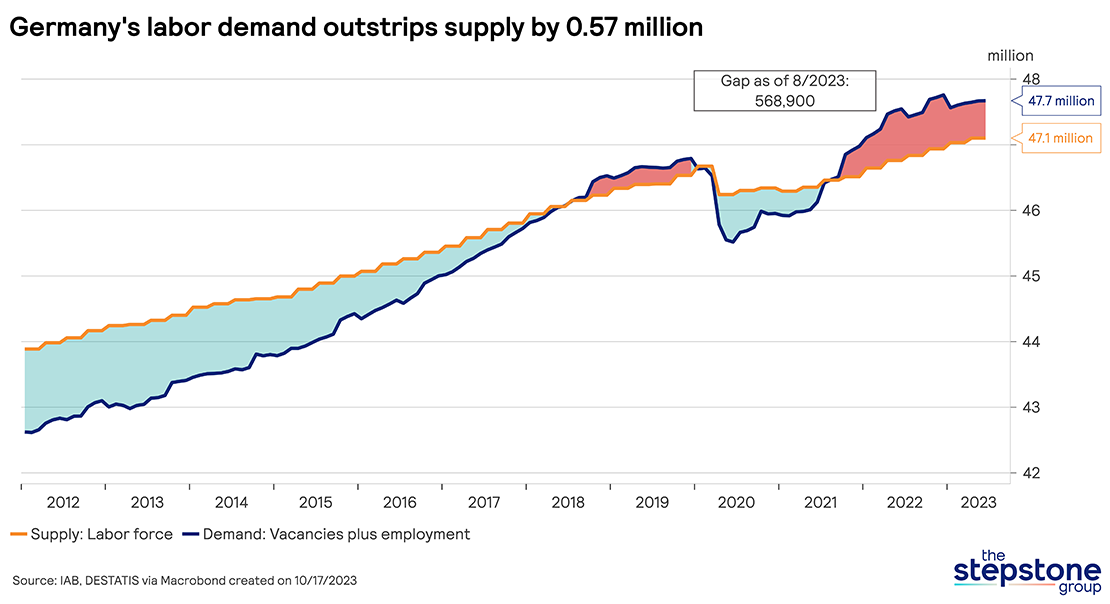

According to the research institute IAB, the total number of job vacancies reached some 2 million at the end of 2022 and still stands at about 1.75 million in early 2023. This is significantly higher than the total number of unemployed – about 1.3 million using the ILO measure.

Stepstone research shows that the costs for an unfilled vacancy can be up to 38,000 Euros. With the intensifying worker shortages, companies find it increasingly difficult to hire staff. The average time to fill a vacancy has tripled from about 50 days in the mid-2000s to more than 150 days recently. The worker shortage is thus not only limiting production, but also driving up hiring costs substantially as recruiters need many months to fill certain positions.

The labor market tightness is also well captured by the following chart in which we plot total labor demand against total labor supply. Labor supply is the total available workforce, meaning all employed and unemployed persons in the economy. Labor demand is proxied by employment plus vacancies. The last value shows that there are some 650,000 missing workers as of now, according to this measure, and that that number is only bound to increase in the foreseeable future due to the aging workforce.

“Full-employment recessions”: What does that mean for recruiters?

Even as Germany’s economy is stagnating or even shrinking, its labor market will remain very tight. Demographic developments in Europe, and in Germany in particular, are producing labor shortages that will only worsen in time. Estimates show that Germany will soon miss several million workers unless the recent surge in migration provide can be maintained and provide some relief.

These developments mean that, similar to Japan, Germany will experience more “full-employment recessions”, unless productivity growth significantly accelerates.

While the recent advances in AI are spectacular, they will only start to have an effect on economy-wide productivity in a few years from now, just as it took time for past technologies to significantly alter and transform the economy. And it is too early to tell to what extent these new technologies will fundamentally affect future economic growth. In essence, the present times could very well determine a company's future success. Foundations must now be set with multinational, tech-savvy teams that prioritize productivity. And, with labor markets set to tighten further and workforce fluidity on the rise, the window of opportunity for companies to gain a competitive edge in the war for talent is not just open — it's wide open.